FOR IMMEDIATE RELEASE

for Monday, May 5, 2025

Attorney Urges City of Sacramento to ‘Take Bold and Decisive Action’ to Say ‘Goodbye Budget Deficits, Hello Economic Growth and Fairness’

SACRAMENTO, CA – With more service cuts, fee hikes and potential layoffs pending in the face of yet another in a series of large and growing projected budget deficits, the city of Sacramento needs a way out.

The attorney and independent advocate who helped defeat the last business operations tax (BOT) reform measure, Measure C, Tiffany Clark, says she has the solution.

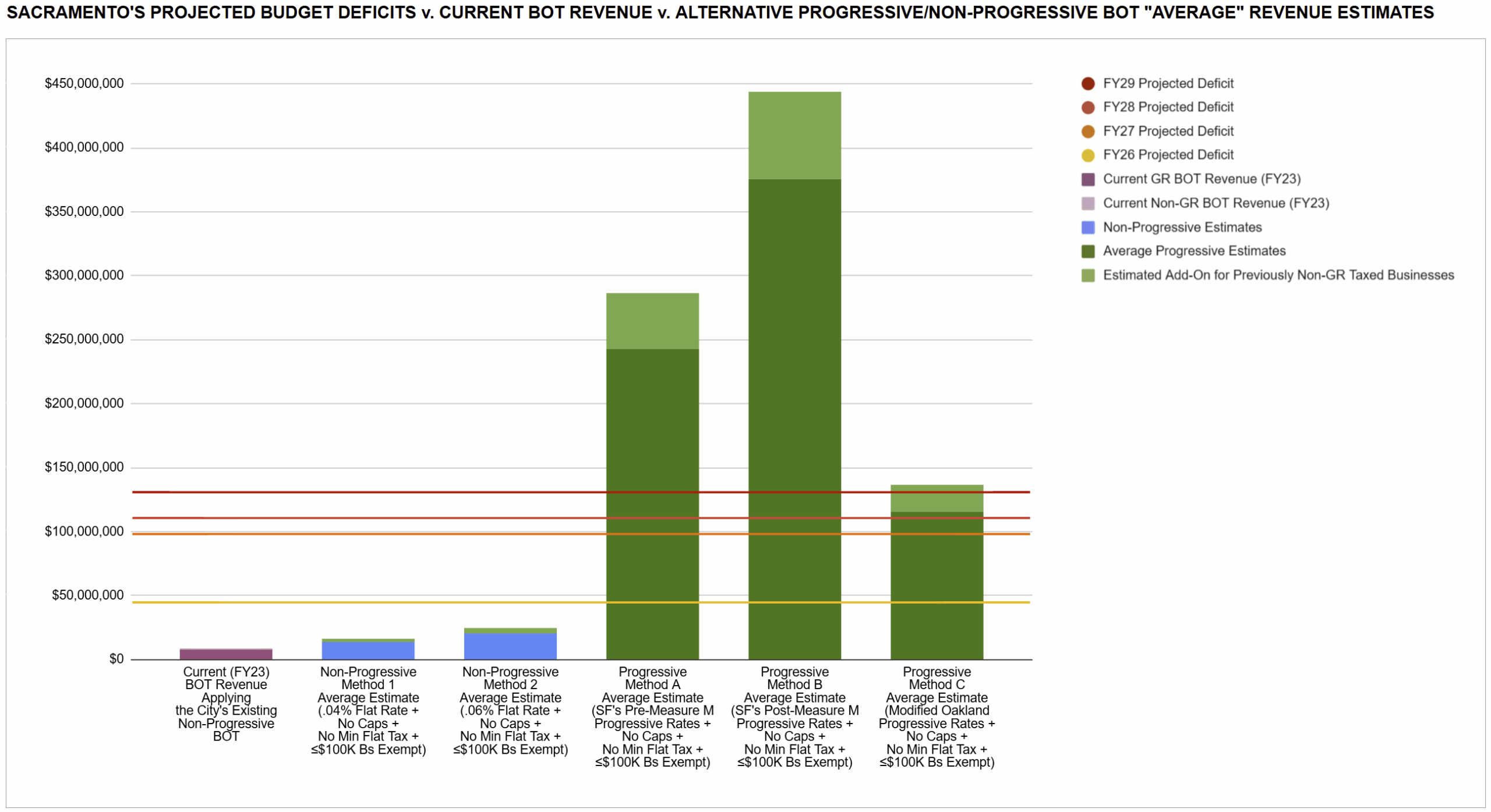

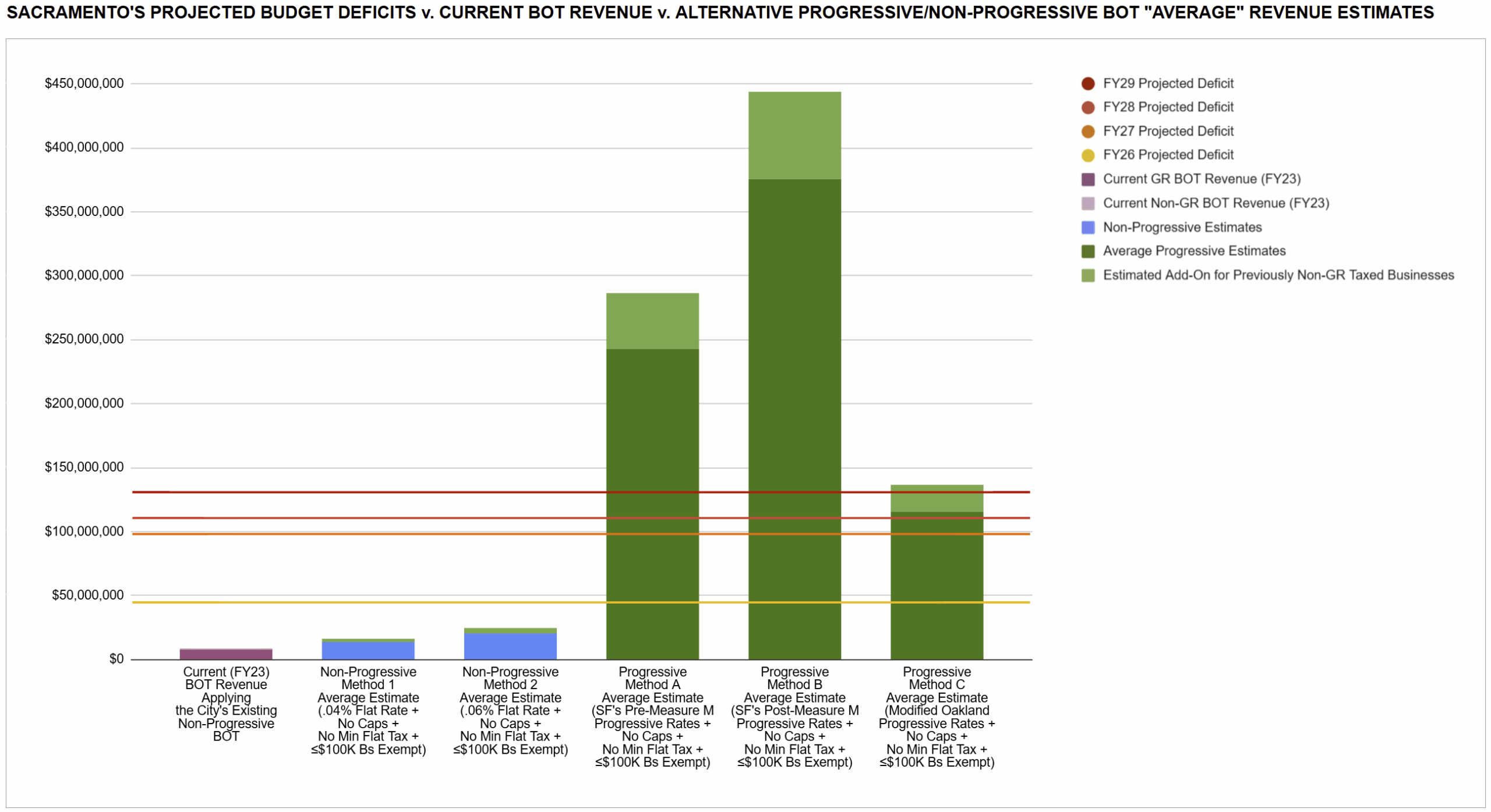

In a letter emailed last week, Clark told the Sacramento City Council that it could “more than eliminate [the] city’s growing projected budget deficits and ongoing unfairness in our business operations tax (BOT) system—while also stimulating economic growth by jump-starting new and small businesses—simply by following the lead of some of the city’s self-identified peer jurisdictions and putting a progressive BOT measure on the ballot in 2026, as the following chart illustrates . . . .”

See the latest version of that chart below, taken from the attorney’s dynamic white paper “Goodbye Budget Deficits, Hello Economic Growth and Fairness” linked in her letter to the council:

“As the chart suggests, the potential is enormous,” Clark argues, noting “Sacramento leaves a tremendous amount of revenue on the table—meanwhile vulnerable residents brace for the next round of city budget cuts, even while still reeling from the last round, whether they participate in park programs, want to start a home business or simply try to park downtown on Sundays.”

“On top of leaving money on the table,” the attorney states, “The city’s current BOT is unfair because it is regressive, meaning the smallest businesses pay the highest effective tax rates and the biggest businesses pay the lowest—in part because of some unusually high minimum flat taxes at the bottom and because of some unusually low tax caps at the top, the latter even while most of the city’s self-identified ‘peer jurisdictions’ have no tax cap at all.”

In addition to “eliminating” the city’s projected budget deficits and increasing “fairness,” Clark claims in her white paper that a progressive BOT would “jump start economic growth by boosting our small and new businesses.”

“Small businesses are the primary driver of economic growth in this country . . . constituting about 99.9% of all businesses, creating more jobs (62% between 1995 and 2020—12.7 million compared to 7.9 million by large businesses) and accounting for 44% of U.S. economic activity, according to the U.S. Small Business Administration,” the attorney explains in her paper.

“Yet the city of Sacramento does not currently do all it can to support small businesses—far from it,” Clark’s paper continues, stating, “From our home occupation permit fees (some of the highest in the nation) to our BOT, Sacramento is burdening such businesses when it needs to be super-charging them the way a number of our peer jurisdictions do.”

It is those peer jurisdictions that provided the inspiration for Clark’s proposal, which, according to her paper, would remove the tax caps and minimum flat taxes, opt potentially all businesses into the gross receipts tax, exempt businesses grossing up to $100,000 annually (or potentially up to between $1 and $5 million annually) and institute “progressive rate ranges.”

“A progressive rate range is a range of rates in which the rates start low and increase with each successive revenue bracket increase,” the attorney explains, adding, “Rate ranges would vary based on different business types/sectors, factoring in their other typical expense and sales tax burdens.”

“So, for example,” Clark continues, “Unless exempt, a business of the sort typically saddled with high business expenses and sales tax obligations might be subject to a relatively low BOT rate range that charges, let’s say, .06% of their gross receipts between $0 and $1 million, .09% of their gross receipts between $1 million and $2.5 million, .14% of their gross receipts between $2.5 million and $20 million, and so on—while businesses types that typically carry lower business expense and sales tax burdens would be subject to rate ranges that start and end with higher rates.”

“With enough time spent negotiating and possibly phasing in fair progressive rate ranges that take particular, industry/sector specific business expense and sales tax burdens into account,” Clark’s paper asserts, “even big businesses can be brought along, knowing the resulting funding will provide the kind of stability and improvements to the city critical to their success.”

In her letter, Clark urged council members and the mayor to “direct staff to add my proposal to the list of BOT options I believe staff plans to analyze and present at the next Law and Legislation Committee meeting.” That meeting is scheduled for May 20.

Meanwhile, the attorney plans to reach out to local stakeholders, receive input and potentially adjust her proposal accordingly. She encourages interested parties to reach out to her, keep abreast of the latest developments by periodically checking the dynamic white paper and spreadsheets linked from within that paper and push the city to adopt her proposal.

“I’m excited about the potential for our city,” Clark says. As her white paper puts it, Sacramento’s city council has the power to “take bold and decisive action to save the day,” which in turn could “lead us out of the darkness of endless budget deficits, fee hikes, service cuts and layoffs and into the light of economic growth and fairness.”